Saving for college & training: 529 savings plans explained

During September, National College Savings Month, families are reminded to look ahead to their children’s education as they settle into their current back-to-school routines.

But with so much going on as school resumes, we understand it’s hard to look beyond immediate schedules and to-dos. To make it easier for you to get the information you need, VSAC, administrator of Vermont’s official 529 savings plan, recorded the most recent VSAC Shows You How webinar, held on September 28, that focused specifically on 529 plans: the what, why and how explained, with common questions answered.

Click above, or watch the full recorded video here.

Highlights from the presentation include:

Why save for college or training?

Studies show that families who save even small amounts for college or training are 3x more likely to attend and 4x more likely to complete college. This is important because just about any job of tomorrow will require some form of education after high school. Completing that training can mean greater opportunities for the future with more jobs at better earnings.

What if I can’t save much now? What difference will my savings make?

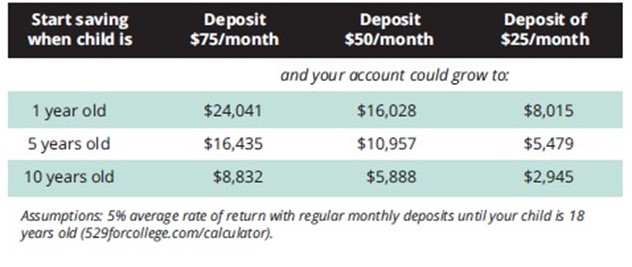

Because 529 plans, named after Section 529 of the Internal Revenue Code, can be opened with $25, they’re accessible for families at most income levels. Even small amounts can add up over time, free of federal and state income taxes, growing as your child grows. Whether your child is an infant or a teen, now is the time to start.

Think saving isn’t worth the effort? Think again. Saving now with a 529 plan can help you reduce your need to borrow money later on. For example, a savings of even, say, $2,945 for college or training by the time your student is 18 years old is money you won’t have to borrow and then repay interest on (at a cost of more than $1,000 over a 10-year loan at current federal student PLUS loan rates). Your investment in a 529 plan can be used to help pay tuition, housing and meals, books, a computer, and other qualified expenses for college and training. And 529 savings can be used for graduate and adult education, too.

Think saving isn’t worth the effort? Think again. Saving now with a 529 plan can help you reduce your need to borrow money later on. For example, a savings of even, say, $2,945 for college or training by the time your student is 18 years old is money you won’t have to borrow and then repay interest on (at a cost of more than $1,000 over a 10-year loan at current federal student PLUS loan rates). Your investment in a 529 plan can be used to help pay tuition, housing and meals, books, a computer, and other qualified expenses for college and training. And 529 savings can be used for graduate and adult education, too.

What benefits do I get with the VT529 plan?

As Vermont’s official 529 college savings program, the Vermont Higher Education Investment Plan, also referred to as VT529, is the only 529 plan that gives Vermont investors a 10% state income tax credit on annual contributions: that's a credit of up to $250 per beneficiary account per year ($500 per beneficiary per year per account for joint filers) for Vermont taxpayers saving for education after high school.

Get started now to learn more about the VT529 savings benefits (including details about tax-free earnings and the VT income tax credit), how to make a savings gift or open an account, and common 529 questions and misconceptions. View the recorded webinar in the link above and learn more about VT529 at vsac.org/save.

Get started now to learn more about the VT529 savings benefits (including details about tax-free earnings and the VT income tax credit), how to make a savings gift or open an account, and common 529 questions and misconceptions. View the recorded webinar in the link above and learn more about VT529 at vsac.org/save.

The Vermont Higher Education Investment Plan, also referred to as VT529, was established in 1999 and is Vermont’s only state-sponsored 529 college savings plan.

The Vermont Higher Education Investment Plan, also referred to as VT529, was established in 1999 and is Vermont’s only state-sponsored 529 college savings plan.