Plan for College Costs

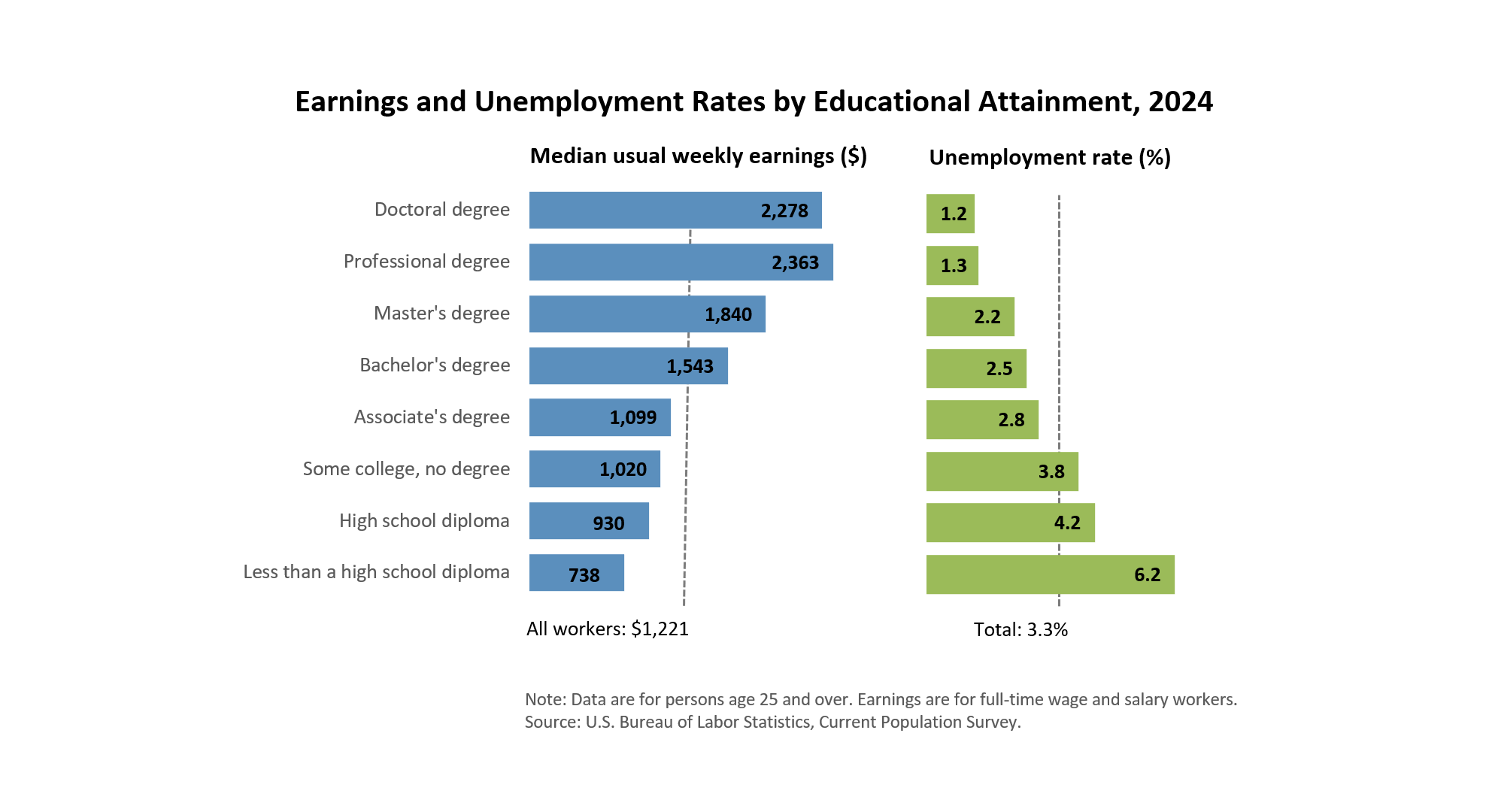

College or career training can be expensive. But it’s also a very good investment. Research shows that people with more education experience:

- More job opportunities

- Better working conditions

- Greater job satisfaction

- Greater sense of control over their lives

- Higher salaries and lifetime earnings

- Better health for themselves and their children

College Pays for Itself Quickly—And Over the Long Haul

Most college graduates will earn back what they spent for a year of college in just 1 year of working. And the benefits don’t stop there. With higher earnings, college graduates not only have the opportunity to enjoy a more comfortable lifestyle during their working years — they also have the opportunity to save and invest more for a financially secure retirement.

Start Your Financial Planning for College Early

Financial planning for college starts with understanding college costs (including tuition, fees, and housing and meals) and figuring out what resources you may have to help cover those costs. Starting your planning early will help you to make smart decisions—and make the most of your investment.

So pull your resources together, get everyone involved who may be able to help with paying for college or career training, and start planning.