Upcoming Events

What You Need to Know About Student Loans

Welcome to Loans 101, the basics on education loans and what you need to know to borrow wisely. If you’re new to the world of education loans, the details can be confusing. As Vermont's non-profit state agency for higher education, we want to help you understand and think smart about loans so you can confidently make the right choices now and manage your education debt successfully down the road.

Why you should use federal student loans first

What to Know Before You Borrow: Cosigners, Credit, and Student Loan Interest

What Are Education Loans and Who Offers Them?

There are two main types of education loans: federal and non-federal.

The U.S. Department of Education offers loans to families for undergraduate education. These typically appear on your financial aid offer.

For students:

Federal Direct loans are for students enrolled in college or a training program at least half-time. There are two types:

- Subsidized (based on financial need)

- Unsubsidized (not based on financial need)

For parents:

Federal Direct PLUS parent loans are for up to the full remaining cost of attendance. PLUS loans are available through your school.

Learn more at the Student Aid website.

These loans, often called alternative loans or private loans, go by all sorts of brand names, depending on the lender. Available through:

- VSAC and other nonprofit state agencies

- your college

- commercial lenders (banks, credit unions)

For students & parents:

Families can use these loan types to cover costs that remain after students borrow federal Direct loans.

Non-federal loans are NOT created equal—each lender sets its own terms, and they have different benefits, interest rates, and repayment options than federal loans.

Students - Accept These Loan Types First

VSAC recommends that you accept federal student loans before considering any other types of loans.

Federal student loans (in the student’s name) from the U.S. Department of Education are considered the best place for students to start. These loans offer benefits like flexible repayment options (for example, making monthly payments based on your income or deferring payments during periods of hardship).

The financial aid office at each school will determine whether you’re eligible for federal loans, based on the information you reported on your Free Application for Federal Student Aid (FAFSA).

VSAC recommends that you accept the maximum in federal student loans—Direct Subsidized first

(if offered), then Direct Unsubsidized—before considering any other types of loans.

| First year | $5,500 |

|---|---|

| Second year | $6,500 |

| Remaining years (up to $5,500 may be in subsidized loans) | $7,500 |

| Cumulative (undergraduate) | $31,000 |

Sub or Unsub?

Federal Direct Subsidized loans, for students with greater financial need, do not accrue interest while a student is in school or in a deferment period. Your school will determine whether you’re eligible.

Federal Direct Unsubsidized loans, available for all students regardless of financial need, start accruing interest when the loan is disbursed (while you’re still in school).

What to Know Before You Borrow:

Cosigners, Credit, and Saving on Interest

If you’re applying for a student loan, it may be an advantage to have a cosigner on your loan. A cosigner—often a parent—is a person with a good/excellent credit history who supports your education goals and agrees to be held responsible for the loan if you fail to make your monthly payments. Having a cosigner with good or excellent credit may enable you to get a lower interest rate on your loan.

A cosigner:

- Is equally liable for the debt

- Is expected to make payments—including any late or collection fees—if the student borrower is unable to pay

- Receives a bill statement each month, along with the borrower

- Is reported to the national credit bureaus each month, along with the borrower

- Must sign all paperwork, along with the borrower

Important note for first-year students and families

Many college students plan to use student loans to help cover college costs—but then they learn that most private student loans, and even some state-based loans, require a creditworthy cosigner. A cosigner’s credit may be a factor in the loan terms you receive—meaning that cosigners with strong credit history may help you qualify for better loan terms and help you build credit.

This common requirement means it’s important to plan ahead—especially since your final college bill often arrives before classes begin.

If you're planning to borrow, it’s important to research loan options early, understand the role of a cosigner, and start those conversations with your cosigner before payment deadlines arrive.

Cosigner release

Cosigner release may be available, upon request, to borrowers with a current account who meet lender requirements. This means your cosigner will no longer be responsible for the loan and will no longer have the debt counted on their credit report—freeing up their credit for other needs.

To learn more about cosigner release, check with your lender. If you're considering VSAC as your lender, learn more about cosigner release on eligible VSAC student loans by reviewing the following FAQs.

VSAC cosigner release FAQs

- What are the eligibility criteria to be considered for cosigner release?

Cosigner release is a benefit available on some VSAC private education loans. To be considered for cosigner release on an eligible loan, all of the following must occur:

- The loan must have been in active repayment for at least 48 months.

- The loan must be current*.

- The primary borrower must meet the applicable credit criteria.

*Current means that you have no past due payments.

- How do I apply for cosigner release?

Primary borrower:

- Log in to MyVSAC.

- Click on the “Loan Info & Make Payments” button.

- Click on the “Cosigner Release Application” button and follow the instructions.

Cosigners are not able to apply for cosigner release, the application must be submitted by the primary borrower.

- When will I be able to select loans for cosigner release in the online application?

You will be able to select eligible loans once the loan meets all the eligibility criteria.

- Why can I only select some of my loans for cosigner release in the online application?

Only loans that are current and have been in active repayment for at least 48 months can be selected. You will either need to bring the loan current (if it is past due) or wait until the loan has reached 48 months of active repayment before you can select the loan.

- I’m a cosigner, can I see which loans are eligible for cosigner release?

No. Only the primary borrower can view through their online MyVSAC account which loans are eligible for cosigner release.

- How do I check to see if I’m current on my loan(s)?

Primary borrower:

- Log in to MyVSAC.

- Click on the “Loan Info & Make Payments” button.

- On the “Summary” screen, under “Past Due” it should say “You have no past due payments” if you are current.

- You can also click on the “Cosigner Release Application” button and refer to the “Days Past Due” column in the chart. If you see a ‘0’ that means the loan is current.

Cosigner:

- Log in to MyVSAC.

- Click on the “Loan Info & Make Payments” button.

- Select the applicable cosigned account that you want to view in the “Select an account” dropdown.

- On the “Summary” screen for the cosigned loan, under “Past Due” it should say “You have no past due payments” if you are current.

- How do I check to see if I’ve reached 48 months of active repayment?

If you are the primary borrower, you can check to see if you’ve reached 48 months of active repayment by following these steps:

- Log in to MyVSAC.

- Click on the “Loan Info & Make Payments” button.

- Click on the “Cosigner Release Application” button and refer to the “Months Active Repayment” column in the chart.

VSAC will also mail letters to both the primary borrower and the cosigner to notify them once the 48 months of active repayment have been met.

- How long does it take to find out if I was approved for cosigner release?

Your application will be reviewed within 10 business days. VSAC will send you notification via mail to let you know if your Cosigner Release Application was approved or not.

- I’m a cosigner, can I still make payments if I am released from the loan?

Yes, however you will not be able to make payments online through your MyVSAC account. If you want to make payments online through MyVSAC, the borrower will need to set you up as an Authorized Payer. Once set up as an Authorized Payer, you will need to login using the Authorized Payer Login.

Click here to learn more about your VSAC loan payment options.

- I’m a cosigner, how and when does my credit report get updated if I am released from the loan?

If you are released as a cosigner, VSAC will notify the credit bureaus that your joint obligation on the loan has been terminated. Once VSAC has released you from the loan, please allow at least 30 days for the update to be reflected on your credit bureau reports.

- Will my cosigner(s) receive notification of the outcome of my application?

Yes, your cosigner will be notified of the outcome of your application.

How student loan interest works

When you take out a student loan, you agree to pay back the loan, plus interest. Your interest rate is the cost of borrowing the money. There are 2 types of rates:

- Fixed interest rates stay the same over the life of the loan.

- Variable interest rates change with the financial markets (the rate can go up!). Variable rates may seem great at first but can end up costing a lot more over the life of a loan.

How interest accrues on student loans

Interest is the fee you pay the lender—such as VSAC or the federal government—in exchange for borrowing the lender’s money. Your interest rate is the percentage of your loan amount (called your “principal”) that you'll be charged for each year that you hold the loan. In addition to this loan amount (or principal), interest accrues (or builds up) on a daily basis. So you accrue 1 days’ worth of interest for each day you owe a balance to the lender.

How payments are applied

Each month, your loan payment is prorated (or distributed) based on the amount due. Your payment is first used to pay any interest that has built up since your last payment. Then, the rest is used to pay down your principal. If your payment is late, the funds will be applied to the most past due loan group(s) first.

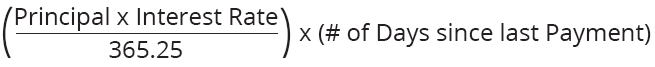

To estimate how much loan interest has built up since your last payment, use this calculation:

How to pay less student loan interest

One of the best ways to reduce student loan interest is to pay extra—even if it’s just a little bit—with each payment.

Here’s why:

Your interest is calculated based, in part, on your principal amount. So the lower your principal, the less interest you’ll have to pay each month. Plus, when your principal balance reaches $0, you have successfully paid your loan in full—and you no longer need to pay principal or interest.

So the goal is to pay down the principal as quickly as possible.

If you send more than the amount due each month, the extra funds are first applied to any outstanding interest and the remaining amount goes directly toward paying down your principal. This helps you to pay off your loan more quickly—and reduce your total estimated interest charges.

5 tips for reducing your student loan interest

Here’s how to keep your student loan interest charges as low as possible:

- Make your payments on time

- Pay a little extra with each payment

- Avoid extending your repayment term

- Avoid deferring your interest payments

- Avoid defaulting on your loan

How to prepay your VSAC loan

Did you know that many students start paying their student loans while they’re still in college—even when it isn’t required? It’s true—and it can be a very good idea. Starting repayment early can help you graduate with less debt and put you in a better position to repay your loan.

With VSAC loans, it’s easy to start repayment early or to pay off your loan early (called “prepaying”). You may prepay all or a portion of your VSAC loan(s) at any time, without penalty.

When you make your monthly payment, include any special instructions you may have for the payment on your monthly payment coupon.

To pay your loan(s) in full, you must pay the principal balance plus any outstanding interest. Contact us for your payoff amount.

If you’ve ever bought a new car or house—or even opened a new credit card or rented an apartment—you’ve probably been asked to provide information so that the lender or landlord can run a credit report.

A credit report is a record of your financial transactions. It includes a history of your bills and loans and when you’ve paid them as well as how much debt you currently have. This report is generated by organizations called national credit bureaus. Each month, lenders report your loans—and their status—to these credit bureaus to update your credit report.

Get more information and advice on how to protect your credit score at myFico.

Does comparison shopping hurt your credit score?

Many folks believe that if they shop around for loans, every inquiry into their credit will have a negative impact on their credit score. Not so.

While the FICO scoring formula does take student loan comparison shopping into account, loan shopping during a certain timeframe (30 days is a good rule of thumb, though this can vary), generally will have little to no effect on your credit score. With that said, it's considered good practice to do some comparison shopping before you apply.

For a more comprehensive discussion of rate-shopping and inquiries, visit myFico.

How credit affects your student loan options

When you apply to take out a new loan—such as a VSAC Student & Parent Loan —your lender uses your credit report to determine how likely it is you’ll pay that loan back on time. And that helps the lender decide how risky it is to loan you the money.

If your report says you have a manageable amount of debt and you pay your bills on time, you’ll be considered a good credit risk—and you may get a better interest rate or a lower fee on your loan. On the flip side, if your report shows you have a large amount of debt or you don’t pay your bills on time, the lender will see you as a bad credit risk. Your student loan may be denied—or you may be charged a higher interest rate and possibly an additional fee.

How on-time student loan payments can lead to a strong credit score

Making your student loan payments on time each month can help you build a strong credit score. And that’s important if you want to borrow money in the future—especially if you don’t have a credit card or other loans that you can use to show your responsibility in paying back your debt.

Time and consistency are 2 of the most important factors in building a credit score. Because student loans are paid each month—usually over many years—they can be a great way to show you’re responsible in paying your bills consistently over time.

To make sure you’re paying on time every month, you may want to set up an automatic monthly payment. Review your payment options for VSAC loans

How late student loan payments can lead to bad credit

Once you have your student or parent loan, you’ll want to make sure to make your payments on time. When you make late payments on your student loan, this gets noted on your credit report—which may affect your options for other loans for a house, car, or other large purchases in the future.

Don’t let yourself fall into a bad credit situation. If you need help repaying your student loans, we’re here to help guide you. Learn more about student loan repayment options >

How to keep an eye on your credit

You can get 1 free credit report from each of the 3 national credit bureaus each year. Vermont residents may also request a second report, under Vermont state law.

You can request a copy of your report by going to the Annual Credit Report website or by contacting each of the credit bureaus individually:

You can find additional guidance on money and credit issues at the following websites: