Upcoming Events

Parent PLUS Loan vs Private Parent Loans: How to Compare

As a parent, you may be guiding your student through education decisions, including how best to pay for college or training.

If you’re considering borrowing money for education costs not covered by grants and scholarships, savings, or future income, you're not alone. The majority of families need to use loans to help pay for education. So, it’s important to understand all the loan options you have available.

Every family’s situation is different, so one size does not fit all. Here are some points to consider as your family makes choices about borrowing.

First, accept Federal Direct student loans

The financial aid office at each school will determine whether you're eligible for federal loans, based on the information reported on your Free Application for Federal Student Aid (FAFSA).

VSAC recommends that families first consider Federal Direct student loans — federal loans borrowed by the student — as those loans have flexible repayment benefits designed specifically for students. (Read our blog about the different types of student loans.)

Because there are annual limits on these loans, some students and parents may need additional funds to close the gap.

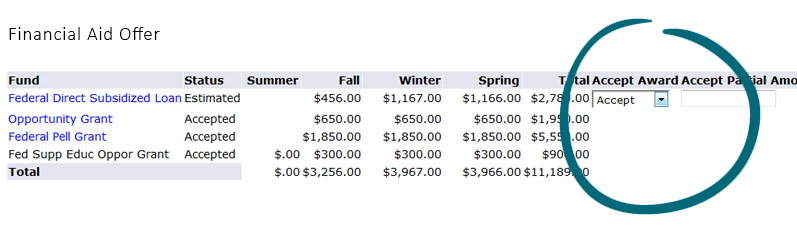

Look carefully at the student's financial aid offer. If you're uncertain which items are student or parent loans and which items are gift aid (money that doesn't need to be repaid), contact the school and ask them to clarify.

Sample financial aid offer of loan to accept

Pause before accepting Federal Direct PLUS loans

Consider if a better option is available before your student checks the box to request or accept a parent PLUS loan on your behalf.

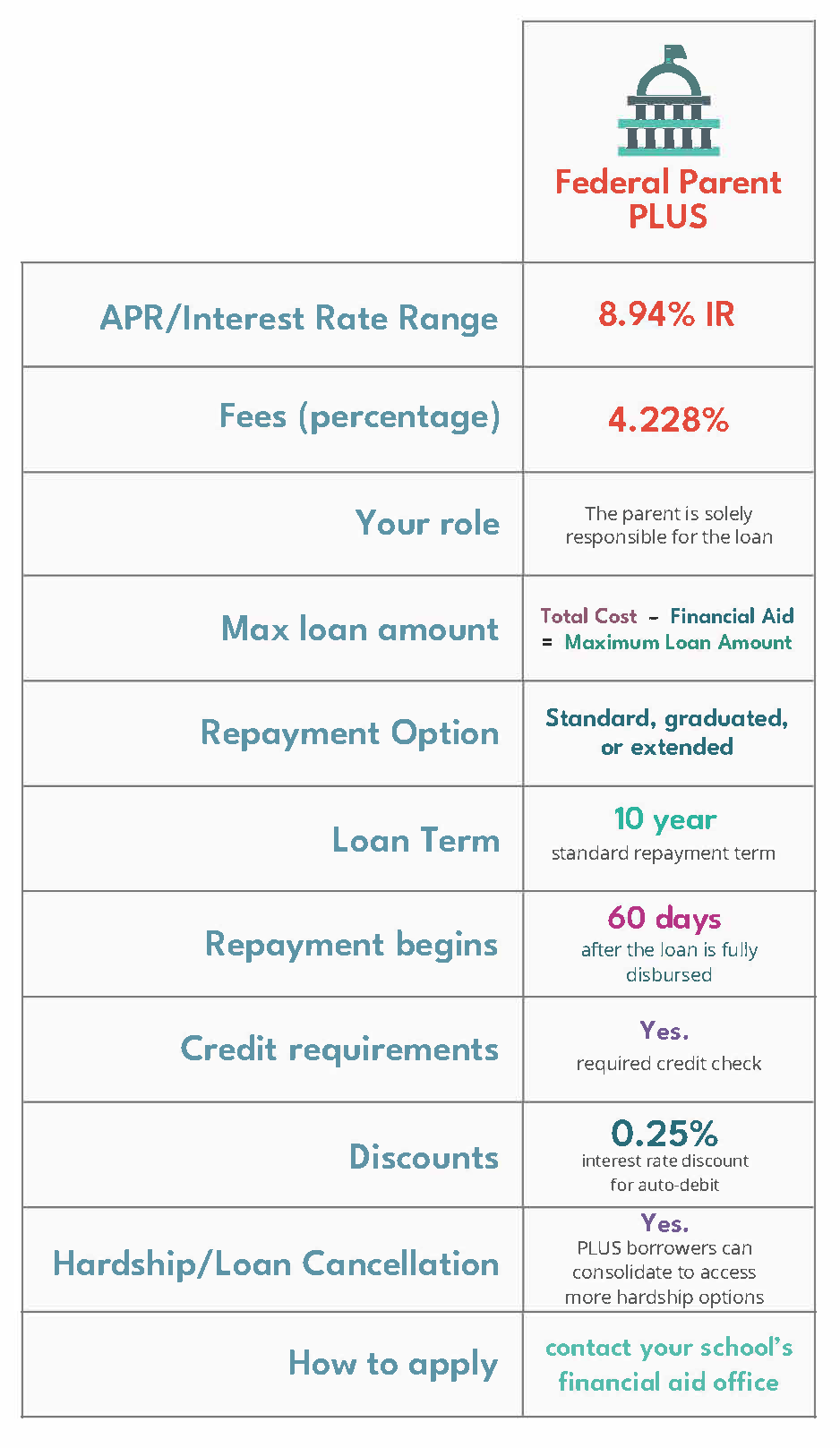

Federal Direct PLUS loan details for 2025-2026

Click to download a printable copy of Federal PLUS versus VSAC

My student’s financial aid package includes a Federal Direct PLUS loan. Should I accept it?

This is one of the most common questions we get each year. It’s a federal loan, so it must be good, right?

Don’t confuse Federal Direct PLUS loans for parents (or simply, parent PLUS loans) with Federal Direct loans for students (also called a Direct or Stafford loan). An easy way to tell the difference is that Federal Direct loans for parents have the word “PLUS” in the title.

Federal parent PLUS loans are designed for parents to cover up to the full remaining cost of a student’s attendance.

These federal loans may be included in a student’s financial aid offer, but the parent borrower is legally responsible for repaying the loan, with interest.

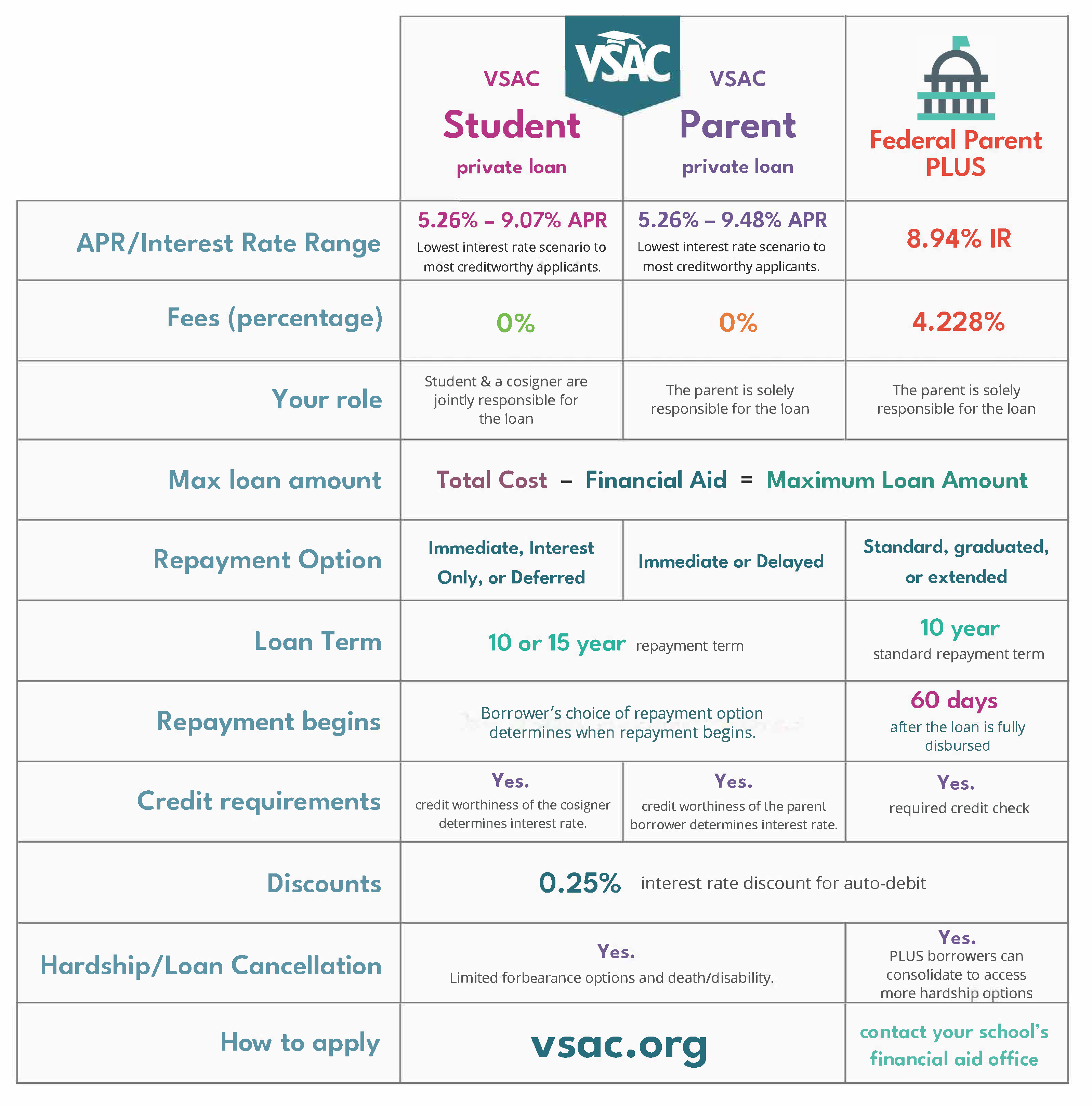

Before accepting a federal PLUS loan, families should consider whether a private loan may offer a better deal for their situation. For instance, the current federal PLUS interest rate is 8.94% + 4.228% in fees. The highest VSAC parent loan for the academic year 2025-2026 is 9.48% and 0% fees.

Private parent loans are an alternative to federal parent PLUS loans

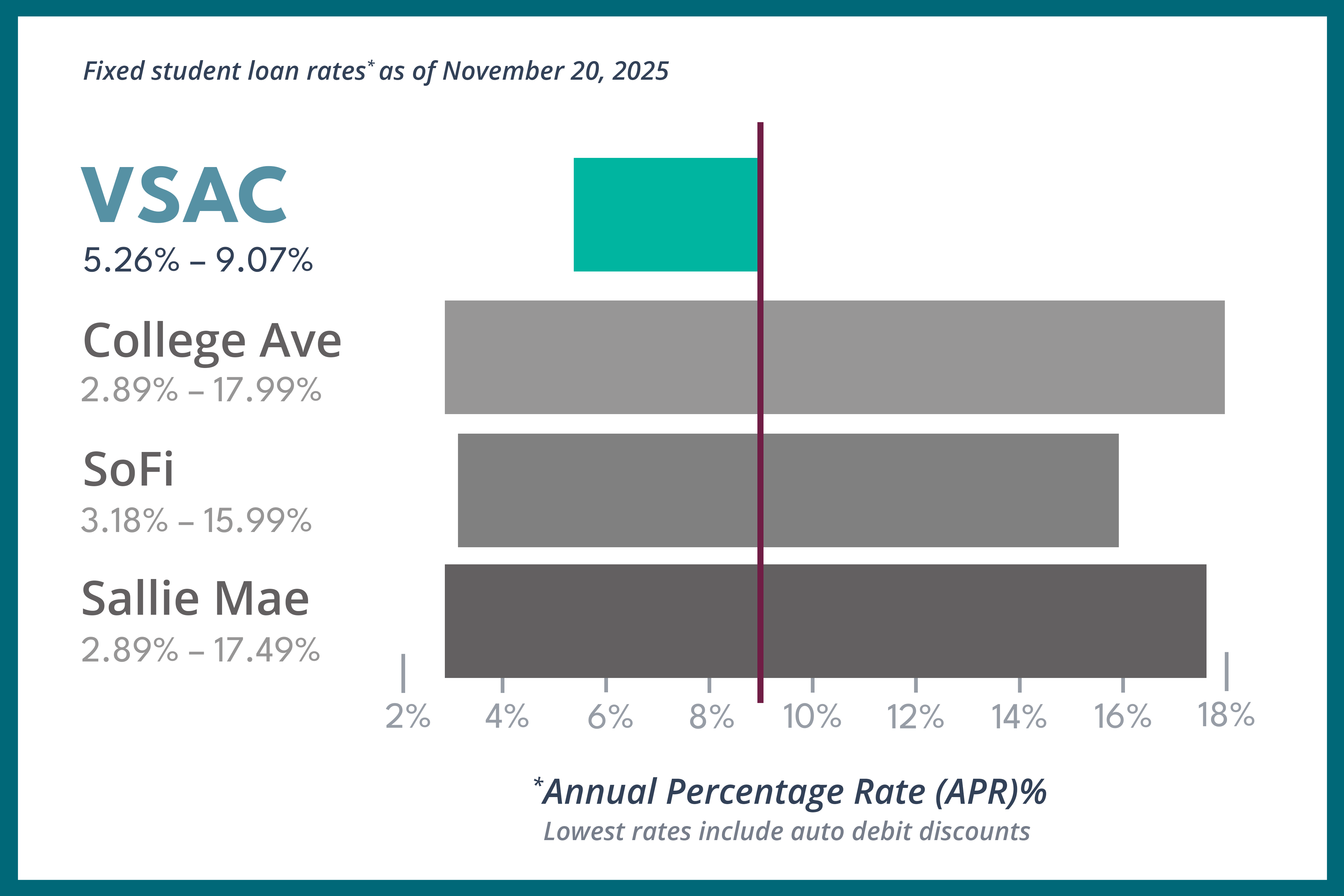

Private education loans are not created equal. Compare rates and terms.

What is a private education loan?

Private education loans are designed for education and training and may have terms and interest rates more favorable than federal parent PLUS loans.

However, private loans vary greatly, with each lender setting their terms and offering different interest rates, fees, and repayment options.

Private loans can be in either a student’s or a parent’s name. If the loan is in the student’s name, often the lending agency will require someone with established credit, such as a parent or another person, to cosign the loan (known as the “cosigner”).

If the private loan is in the parent’s name, the parent is the sole borrower.

When shopping for a loan, it’s important to consider the full interest rate range and not be caught up by the lowest rate offered.

For instance, large national commercial lenders such as Citizens, SoFi, and Sallie Mae currently offer rates that, at the higher end of the rate range, are almost double the annual cost of a VSAC education loan.

Get the best education loan for your situation

10 frequently asked questions when comparing loan options.

Since each loan has its own set of unique attributes, these 10 frequently asked questions will help make comparing options easier. We’ve answered these questions for the PLUS loan to get you started. Follow along with our PLUS vs VSAC parent loans to see the differences.

- 1. Who can borrow the loan?

Federal parent PLUS loans are for qualifying biological or adoptive parents (and, in some cases, stepparents) of students enrolled at least half-time in an eligible program at a participating school anywhere in the U.S. or abroad. The student must be eligible for federal student aid and have completed a Free Application for Federal Student Aid (FAFSA), the U.S. Department of Education’s aid application. Before a parent can apply for a Federal Direct PLUS loan, the student must first accept the maximum on a Federal Direct student loan for the academic year.

Private eductation loans generally offer a student loan option, where the student takes out the loan in their name with a creditworthy cosigner (typically the parent) sharing the responsibility. Some lenders like VSAC also offer a parent-only option. Like federal loans, private lenders require that students are enrolled in a participating school or program.

- 2. How much can a parent borrow?

The maximum you can borrow for a federal parent PLUS is the cost of attendance at the school the student will attend minus any other financial assistance the student receives, as determined by the school’s financial aid office.

Many private education loans, including the private parent loan offered by VSAC, follow this same approach.

Borrow only what you need to minimize what you’ll repay.

- 3. What are the credit requirements?

For the federal parent PLUS loan, there is a required credit check. Borrowers with an adverse credit history may still be able to receive a federal PLUS loan if they meet additional requirements.

Parents applying for a private education loan will need to meet credit criteria set by the lender. If you are working on building or repairing your credit, the federal PLUS loan may be your best option.

- 4. What is the loan interest rate?

The interest rate is the cost of borrowing money. The lower the interest rate, the more favorable the loan.

Federal parent PLUS loans for the 2025-2026 academic year have a single fixed interest rate of 8.94%. The interest rate remains the same for the life of the loan.

Private loan interest rates can have a variable or fixed interest rate and vary by lender. The interest rate you receive is based on the creditworthiness of the cosigner (for student loans) or the parent taking out the loan. Private loans are required to provide a range of lowest and highest interest rates stated as an annual percentage rate (APR) to provide consumers a way to compare loan costs.

It's natural to focus on the lowest rates when loan shopping, yet the lowest rates are often reserved for people with the best credit. Consider the full range to get the best rate for your situation.

- 5. Are there fees?

Federal parent PLUS loans charge a fee of 4.228% of the total loan to process new applications. This origination fee is deducted from each payment to your school over time, which can make the federal PLUS loan more expensive than private loans.

Many private lenders, like VSAC, do not charge fees. Shop around to get the best deal.

If you choose an option with fees, find out if the fees will be deducted from or added to the total amount requested so that you are requesting the correct loan amount during the application process. For instance, the current federal PLUS loan includes fees of 4.228%. This means for every $10,000 borrowed, the parent will pay a fee of $422.80. The origination fee for federal PLUS loans is deducted from the funds that are distributed to the school. Some families are surprised when fees are deducted from the total amount and they are left with a balance on their tuition bill.

- 6. Are there discounts?

Federal parent PLUS loans offer an auto discount of 0.25% under certain circumstances. Check the studentaid.gov website for more information on auto debit discounts.

Many private lenders, such as VSAC, offer an auto debit discount as a perk once the borrower enters repayment.

Most lenders require the borrower to sign up for the auto-debit discount once they enter repayment. Ask about the details so that you don’t miss out on this benefit.

- 7. What is the repayment length?

Federal parent PLUS loans offer 10-year standard repayment and extended or graduated repayment plan options.

Private loans can offer repayment lengths as short as 5 years, and as long as 25 years.

Longer repayment lengths will cost you more over the life of the loan. If you choose a longer repayment length, you can always pay it off earlier. Federal and private loans do not carry a prepayment penalty for extra payments, or for paying off the loan early.

- 8. When would repayment begin?

Federal parent PLUS loans begin repayment 60 days after the loan is fully disbursed, although with PLUS loans parents may elect to defer payments until the student is no longer enrolled half-time or less, and six months after.

Private lenders offer different repayment schedules, such as starting payments immediately (15-45 days) after the loan is disbursed or delayed repayment (12 or more months). You make this selection at the time of taking out a loan.

Although payments may be deferred or postponed, interest will begin to accrue once the loan is disbursed to the school.

- 9. What are the payment suspension options for special circumstances?

Federal parent plus loan borrowers can request to suspend payments while the student is enrolled in school and during their six-month grace period.

If you think you may need to defer or delay payment based on financial hardship, or if your credit needs work, a federal parent PLUS loan may be a better option than a private parent loan. Federal parent PLUS borrowers can become eligible for additional options by consolidating their parent PLUS loans into a Federal Direct Consolidation loan.

Private lenders each determine their approach for hardship situations. With any suspension of payments, it’s important to understand how they affect interest and credit.

Federal loans may be discharged upon the death or permanent disability of the borrower, or student.

Each private lender sets their own policy for handling death and permanent disability. For example, VSAC loans may be discharged upon the death or permanent disability of the borrower, or the death of the student.

- 10. How do I apply for a loan?

Before you apply, make sure you understand the differences between a federal parent PLUS loan and a private parent loan. This will help you decide which loan you want to pursue.

To apply for a federal parent PLUS loan, contact your school or program’s financial aid office, or visit studentaid.gov.

If your primary focus is interest rate and you are unsure what rate you’ll get with a private lender, you can begin an application to see what rate you might be offered. If it’s not what you expected, you can cancel or decline the application. Shopping for student loans does not generally affect your credit score if done within a certain window of time.

Learn more about VSAC student loan eligibility and parent loan eligibility.

How VSAC loans compare to federal parent PLUS

An in-depth look at the 10 questions.

Click to download a printable copy of this chart with expanded information

VSAC is here to help

Contact us at any time.

VSAC understands each family has unique circumstances, making loan choices challenging. We work hard to provide favorable rates for all families.

Sometimes research brings up more questions than answers, and VSAC is here to help. First and foremost, our focus is to help you reduce costs—from grants, to scholarships, to loans—for college and training.

Do you want to discuss your questions or need more information? Call one of our specialists at 800-226-1029, 8 a.m. to 4:30 p.m., Monday through Friday, and reach us via email at info@vsac.org.