How to understand your financial offers

Once you have acceptance letters in hand, keep an eye out for emails or snail mail containing financial aid offers from each school. These offers are based on the details you provided on your FAFSA and other financial forms the school might have requested.

Each school will provide a breakdown of the cost of attendance (COA) and the financial aid available to cover the total cost of your education.

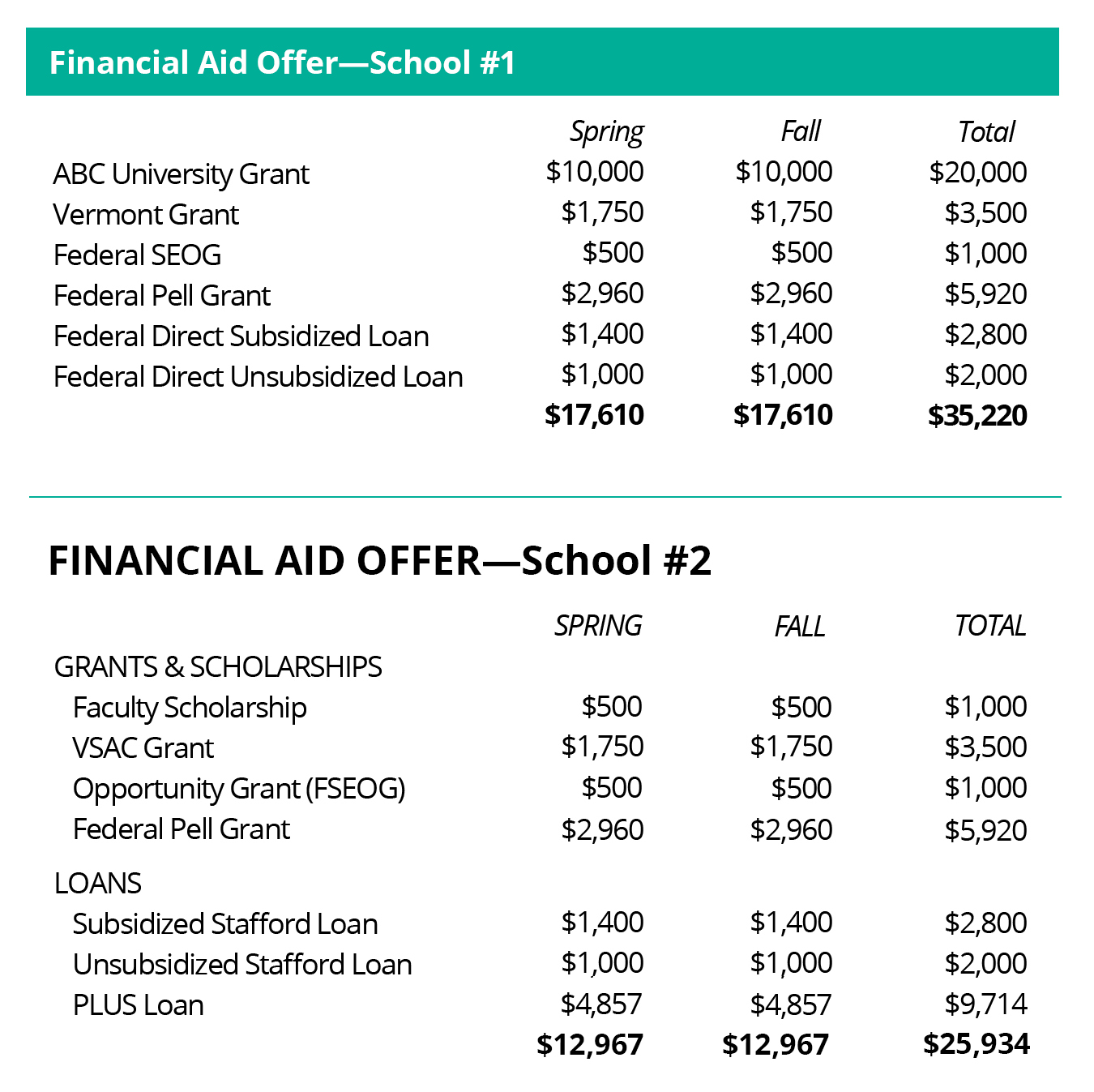

Expect each offer to be unique since each school has its own financial aid policies and ways of distributing funds. For example, you might notice differences in the money offered, and differences in the language used to describe grants and loans. There's a lot to consider when making your final choice. But we'll make it easier.

Breaking Down the Language

There's no one-size-fits-all for these financial aid offers, so don't be surprised or worried by the layout, numbers, or terms used. Although different schools will use different terms, most financial aid offers include some or all of the following:

The one thing they'll have in common is that they may include any or all of the following:

- Grants: free money provided by colleges, state agencies, and the U.S. Department of Education

- Scholarships: student aid offered by different groups, organizations, and even individuals

- Loans: borrowed money that you'll need to repay with interest

- Work-study: an on-campus job that requires a certain number of hours each semester. (To be considered, you’ll have to choose work-study as an aid option when filing your FAFSA.)

You’re not alone if you find it hard to interpret your offer. That’s where VSAC comes in. You can view or download our financial aid vocabulary (PDF) to become more confident when reading your offers. And if you still have questions, you can contact VSAC and we can go through the offer together.

WHAT'S MERIT AID?

Merit aid is free money from a school. It isn't based on financial need. Instead, it is given to students who have academic, athletic, or artistic skills. It could also be given to students who meet certain traits that the school is looking for.

Understand the Differences in Your Offers

It’s unlikely that you’ll receive two financial aid offers that are exactly alike. Two of the most common areas that create confusion: the differences in how schools describe their free aid and student loans.

You might see this listed as the:

- Vermont grant (because the money comes from the Vermont Legislature)

- VSAC grant (because VSAC administers the grant and students must apply for it through VSAC)

- Incentive grant (the name of the specific grant for full-time students)

These aren't 3 different grants; they're just 3 different ways that schools might refer to Vermont's state grant.

You might also see different names for student (and parent) loans. Loan program names have changed many times over the years, and each school’s language for referencing federal loans is often inconsistent. Just know that:

- Student loans are currently called Federal Direct loans and may appear as DL Sub, DL unsub, Direct Loan – unsub, sub.

- Schools might list loans as Stafford loans.

- You might even see them listed as Ford loans.

- PLUS loans are federal loans typically taken out in the parent's name.

If you have any questions about the types of aid on your financial aid offer, call the school's financial aid office to get more clarity. If you’re still confused, contact VSAC so we can work together to answer any lingering questions.

Spot the differences

In the two examples here, the same state grant is listed with different names (Vermont grant and VSAC grant). The federal loans are also the same, even though the first offer calls them Direct loans and the second offer calls them Stafford loans.

Can you spot another difference in the way the 2 examples refer to the same federal grant?

Listen to VPR’s Navigating College Financial Aid Letters podcast featuring a review of 4 college acceptance offers

Federal Direct Loan vs PLUS Loan

Federal Direct loans are offered by the U.S. Department of Education to eligible students and parents to help cover the cost of college or career training. These loans come with fixed interest rates and flexible repayment options. There are three main types of Federal Direct Loans:

1. Direct Subsidized Loans: These loans are available to undergraduate students whose FAFSA application shows they require additional financial support. The U.S. government pays the interest on these loans while the student is in school at least half-time. They also cover the interest during the grace period after leaving school, and during deferment periods.

2. Direct Unsubsidized Loans: These loans are available to undergraduate and graduate students, regardless of their financial status. Unlike subsidized loans, the student is always responsible for paying the interest on unsubsidized loans.

For both loans, students are the sole borrower and responsible for repayment. For all loan offers, you aren’t required to borrow the full amount. We suggest families only borrow what they need.

3. Direct PLUS Loans: This is a loan for parents of students. The parent is the only borrower for PLUS loans and the loan cannot be transferred to the student.

Like the Direct Unsubsidized Loans, interest will accrue interest once the money is sent to the school.

Parents, it’s your choice whether or not to borrow some or all of the amount offered. Federal PLUS loans have flexible repayment options, such as deferment during periods of hardship. PLUS loans interest rates may also be higher than available alternatives, unlike federal Direct loans for students.

Before borrowing the PLUS loan, pause and shop around for a loan with the best rate and other benefits for your situation. Compare VSAC’s latest loan rates compared to common competitors.

Do you qualify for a PLUS loan?

If your student is offered a PLUS loan, you as the parent will need to submit a separate application in order to determine whether you're eligible. If, as a parent, you're denied a PLUS loan, your student may receive an additional amount of a federal Direct loans.

Once you’ve separated free aid from loans, it’s time to crunch the numbers and get the full picture of your financial aid offers, along with your potential costs. This will help you identify the school that gives you the best deal.