Upcoming Events

Student Loan Refinance

Reduce your monthly payments or pay off loans faster—with no origination fees and a fixed interest rate.

Looking to simplify your student loan payments or save money with a lower interest rate? VSAC’s student loan refinance program offers a straightforward, affordable option—with no origination fees, a fixed interest rate, and personalized support from a local nonprofit lender. Whether you want to combine multiple loans, lower your monthly payments, or pay off your loans faster, we’ll guide you through the process with clarity and care. This page has everything you need to decide if refinancing is right for you—and how to get started when you’re ready.

Learn more about VSAC student loan refinance eligibility.

Why Refinance with VSAC?

When it comes to refinancing your student loans, you have options. Refinancing with VSAC could help you reduce your interest rate, lower your monthly payment, or simplify repayment by combining multiple loans into one. We're not a big national lender, and we think that's a good thing.

Why refinance with VSAC REFI?

• Fixed interest rates

• No origination fees

• Cosigner and no-cosigner options depending on your creditworthiness

• Refinance up to $250,000 (minimum $10,000)

• A team with more than 60 years helping students and families realize their education goals

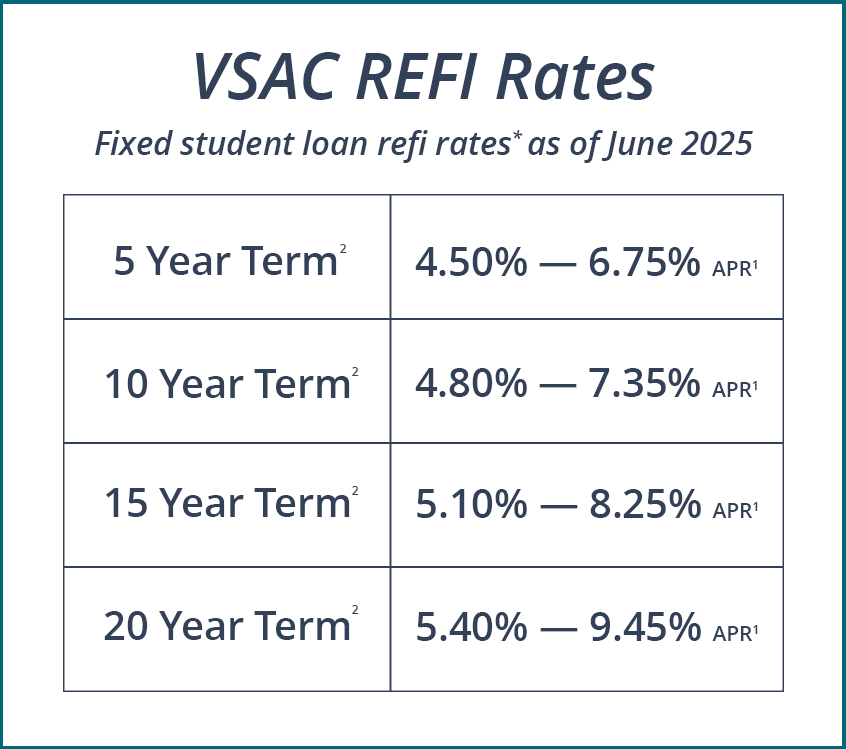

• Repayment term options with 5, 10, 15 or 20 years and corresponding APRs are available based on creditworthiness

• 0.25% interest rate discount for auto debit3

As a nonprofit, we serve students and families—not shareholders.

Cosigners — Required or Optional?

Depending on your credit and debt-to-income ratio, you might need a cosigner. And even if you don’t, adding one with strong credit can help you qualify for a better interest rate. If you do use a cosigner, know that you’re in it together—and they’ll share responsibility for the loan. You’ll also want to understand what happens if either borrower faces hardship or disability.

Cosigner responsibilities are serious, but there are protections built in. For example, if the primary borrower becomes permanently disabled or passes away, the loan may be discharged.

We’re happy to walk you through what these options mean for you and your cosigner.

What You'll Need to Apply

.png)

Getting started is easy, but there are a few key documents you’ll want to have on hand. We’ll need info to verify your monthly housing costs (like rent or a mortgage), your income, and your employment status. It’s all about helping us (and you!) get a clear picture of your financial situation so we can offer the best possible terms.

To apply, you’ll need:

• Recent proof of income

• Verification of employment

• Details about your monthly housing expense (either rent or mortgage)

You’ll also need to provide a complete breakdown of each student loan you want to refinance. That means entering loan information at the individual level—not just by lender—to ensure accuracy. Taking the time to input complete and correct information helps us offer you the most accurate loan terms and avoids delays in processing.

Which Loans are Eligible for VSAC REFI?

You can refinance a wide variety of student loans through VSAC REFI, including federal Parent PLUS Loans, private education loans from national banks, and even consolidated education loans. Just make sure to include each individual loan—not just your lender name—when you apply. That way, we can pay off your existing loans accurately and set you up with one simple monthly payment.

A note on federal loans: If you have federal loans and rely on benefits like income-driven repayment, loan forgiveness, or deferment options, refinancing into a private loan will remove those protections.

And if you currently hold loans with lower interest rates than what we can offer, refinancing could actually cost you more in the long run.

We encourage you to weigh your options and reach out to our team with questions.

I'm Ready to REFI

This stuff can feel complicated. That’s why our team is ready to help. We’ll answer your questions honestly—no jargon, no pressure.

If you have questions about the loan process, your recent application, or anything related to college or career financial planning, contact VSAC.

Give us a call to speak with one of our counselors. Monday–Friday, 8:00 am–4:30 pm EST, 800-226-1029

About Your Interest Rate

1For each repayment term, lowest APRs are available for the most creditworthy applicants and do not include VSAC’s 0.25% interest rate discount.

2Term options are available based on the creditworthiness of the applicants.

3To receive a 0.25% interest rate discount, the borrower must enroll in VSAC’s auto debit through LoanPay. The interest rate discount benefit is for VSAC Student, VSAC Parent, VSAC Choice loans, and VSAC REFI with credit approved on or after May 15, 2025, for the 2025–2026 loan product year. The discount applies during active repayment when you make full or agreed upon reduced payments, as long as: (1) Your monthly payment is successfully withdrawn from the authorized bank account each month; (2) All your VSAC loans are 15 days or less past due; and (3) You agree to receive paperless statements. The interest rate discount is suspended during no-pay forbearance, after 3 consecutive failed payments, or if you cancel paperless statements or auto debit. The interest rate discount will not be reflected in the credit agreement, or disclosures you receive. You must enroll in VSAC’s auto debit through LoanPay when your loan enters repayment.

VSAC reserves the right to modify, terminate, or discontinue borrower benefits at any time, at its sole discretion.