Planning for college or training next year? Apply for the Vermont Grant and explore VSAC’s free scholarship booklet to help you cover costs.

Student loan scams are on the rise - Two scams to avoid and ten red flags to notice

Troubling times create perfect opportunities for scam artists to take advantage of your anxiety and fear about the future. Last year, Vermont Attorney General Charity Clark warned Vermonters about several scams related to emergency relief services following statewide flooding. Scammers are professionals who find any angle to confuse and disarm you, so whenever disaster hits close to home, remember to focus on working with organizations you know and trust. And with tuition bills at your desk, student loan scams are on the rise.

Fraudsters have been peppering cell phones and email inboxes for the last year with claims that borrowers need to register with them to qualify for loan forgiveness. These scammers even offer access to early rounds of funding.

According to the Federal Trade Commission, scammers are increasing their efforts as anxiety mounts about student loan payments and interest payments. Recently, scammers pretended to be affiliated with the Department of Education to collect illegal junk fees for fake student loan debt relief, scamming Americans out of $20.3 million.

Two Student Loan Scams to Avoid

As Congress and President Biden continue to negotiate over student loan forgiveness plans, Remember two things:

#1: You don’t need to do anything or pay anybody to sign up for any Federal student loan relief program.

There’s no early access to forgiveness, line cuts, or even guaranteed eligibility. So, anyone who says they can help you get “in” is trying to scam you.

#2: There’s no reason to pay for help with your Federal student loans.

“There’s nothing a company can do that you can’t do yourself for free,” the FTC says. So if anyone tries to charge you for their “expertise,” you’re being misled.

Beware of FAFSA Scams, Too

Beware of FAFSA scams, which exploit families during stressful times. Avoid sharing personal information through unsolicited text or phone contacts. Legitimate FAFSA communications come from the U.S. Department of Education, Federal Student Aid, and your college's financial aid office.

Free Student Loan Support is Available

The U.S. Department of Education and its federal loan servicers offer these options and services to help student loan borrowers:

- lower monthly loan payments

- repayment plan changes

- multiple federal student loans consolidation

- monthly payment postponing while you’re furthering your education or are unemployed

- loan forgiveness

- getting out of default

You can get support managing your loans at the Federal Student Aid website. If your loans are from a private lender, you can and should speak to your lender directly to discuss your options.

Even if you don’t have a student loan with VSAC, you can reach out to us for free assistance or answers to any questions. VSAC’s financial aid counselors work with more than 43,000 borrowers yearly to provide free counseling on student loans and repayment. Our financial aid experts can walk you through loan terms, advise you on repayment plans, and offer resources to make you an informed buyer who can spot a student loan scam instantly.

Instantly Call Out These Ten Red Flags

Scammers always have the latest resources, from “official” names, seals and logos to email addresses that look official at a quick glance. They may even say they’re affiliated with the U.S. Department of Education. So as the potential for student loan scams increases over the coming weeks and months, VSAC’s loan counselors want students and their families to watch out for these ten red flags from student loan scammers who:

- Ask you to pay up front, or monthly fees, for access to help. Remember, you never have to pay for help with your student loans.

- Use pressure tactics, such as, “If you don’t pay now, you’ll miss this opportunity.” A lot of information you can find on your own for free.

- Promote ads (radio, podcast, social media) offering “debt relief.”

- Ask for a credit card or bank account number. Never give out personal information to a business or organization you haven’t researched online. You could be putting yourself at risk of identity theft.

- Ask for your Federal Student Aid (FSA) ID or login information. “If you share that number, the scammer can cut off contact between you and your servicer — and even steal your identity,” says the FTC.

- Promise immediate and total loan forgiveness or cancellation.

- Ask you to sign and submit an authorization form or a power of attorney.

- Send emails or texts that contain spelling and grammatical errors.

- Leave voicemails saying they’re returning your call.

- Text you loan offers.

How Do You Spot a Legitimate Loan Agency?

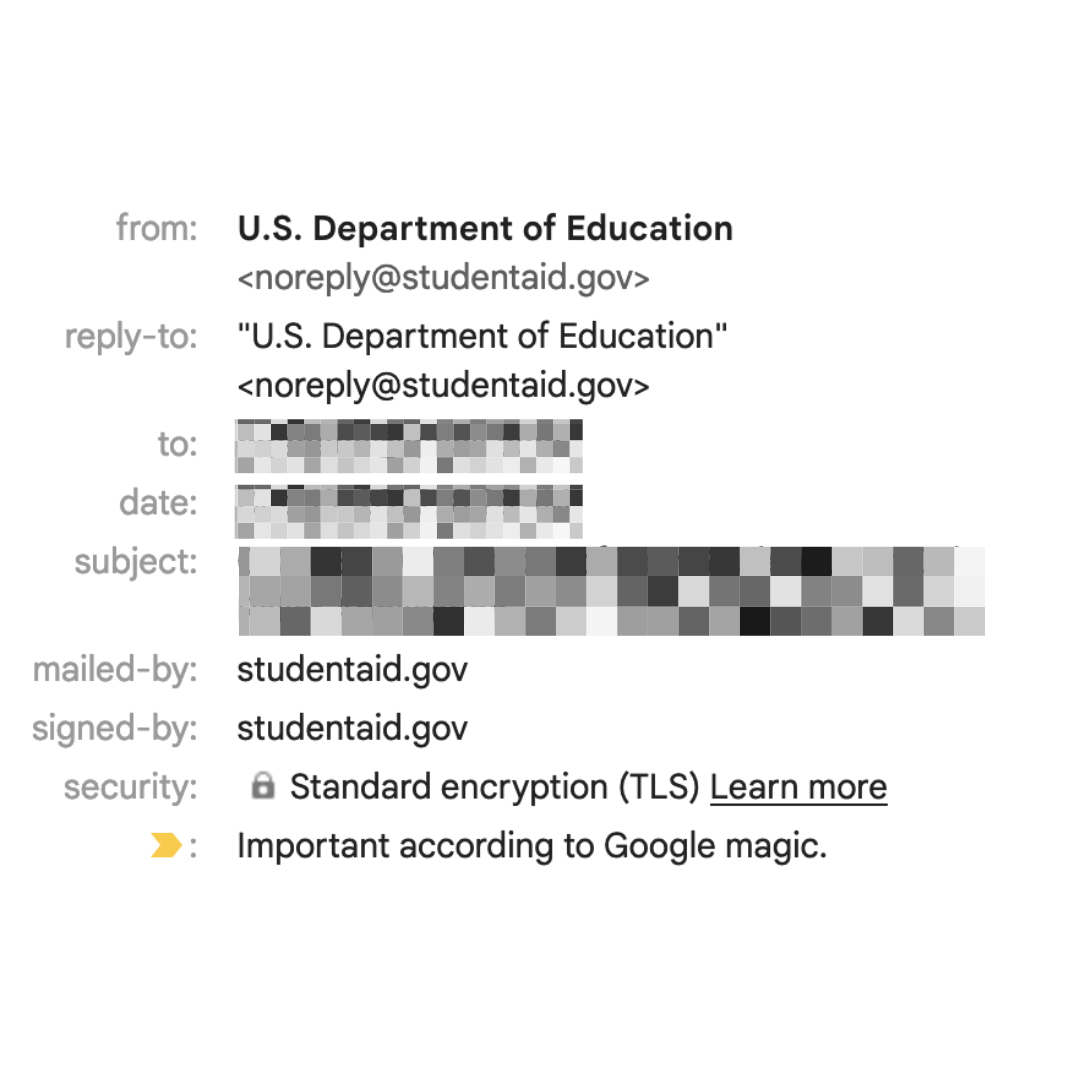

If you’re looking for resources on a government loan, verify that you’re communicating with the U.S. Department of Education, its office of Federal Student Aid, or one of its official federal loan servicers.

There are several private companies, called federal loan servicers, that work on behalf of the U.S. Department of Education. The Department contracts with these loan servicers to handle billing, repayment plans, loan consolidation, and other services.

If you receive a student loan email from a government agency, verify that the sender’s email address is one of the following:

- noreply@studentaid.gov

- noreply@debtrelief.studentaid.gov

- ed.gov@public.govdelivery.com

Student loan scammers create official-looking email addresses and include official seal or logos in their signature to legitimize their scam. You can hover over the From/To section in your email to verify.

Student Loan Resources to Avoid and Report Scams

For questions about student loans, call 1-833-802-8722, 8 a.m. to 4:30 p.m. EST, or email VSAC.

Received a scam call? Report it.

If you believe you may have received a call, text or email message from a scammer, email the Vermont Attorney General’s Consumer Assistance Program, call 800-649-2424, or fill out the online form. Your report may save a fellow Vermonter from becoming a victim.